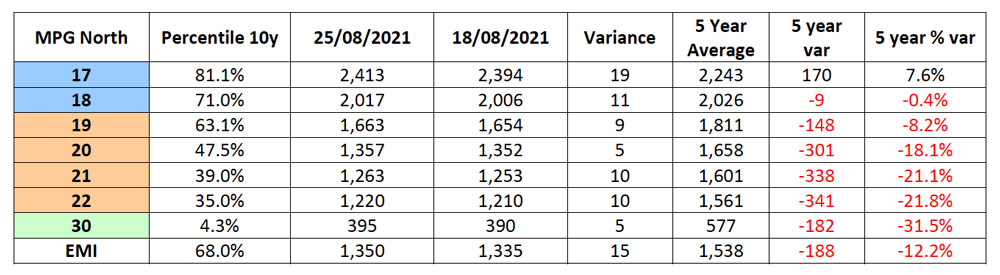

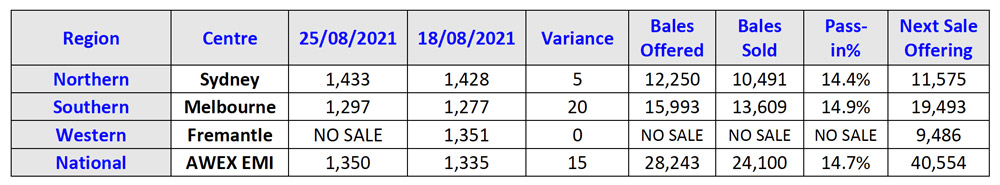

Week S08: The AWEX EMI closed on 1350c this week - up 15c at auction sales in Sydney and Melbourne. With Fremantle sitting out of the roster, just 28,243 bales went under the hammer with a clearance of 85.3%. Once again, 9.5% of the offering was withdrawn before sale as sellers are becoming more sensitive to the market levels they offer into.

Merino Fleece opened immediately dearer and by the close of the market, the MPG’s increased by 19-35c across the entire merino range. Whist the competition came from Local Export Trading houses and Chinese indents, there was substantial European influence on a specific merino fleece specification.. Wednesday’s market opened with expectations of further rises however the expected result did not materialise. Wednesday’s pass in rate increased 4% over Tuesday. Post sale exporters reported difficulty in selling at the current level, in fact sales since Wednesday’s market close were almost non-existent.

Merino Skirtings willingly followed the fleece trend on Tuesday, with price levels increasing by 10-20c, however unlike the fleece, this trend continued into Wednesday with the sector closing with competition to the end.

Crossbreds opened firm to 10c dearer for the low VM clips that were well classed and displayed good specifications. All crossbreds are experiencing record low levels especially on the coarser end, and whilst supply is scant, this market may hold. An increase in volume in 4-6 weeks may apply downward price pressure on this market segment once again.

Merino Cardings were the only sector to measure small losses for the week with a 7c fall in the MC. Crossbred oddments are split in their performance. 24.5µ and finer seem to have consistent price support at reasonable price levels whilst the coarser micron oddments remain under an extremely depressed price basis.

Whilst it is not unusual for the change of season to create a void in demand in the northern hemisphere markets, the substantial increase in purchasing from China last season has left above expected stocks in Tops yarn and finished garments. The re-emergence of COVID-19 cases around the world has placed more doubt in the minds or retailers and consumers regarding the timing of society resuming any resemblance of normal.

Next week’s National offering climbs back up to 40,554 bales in all centres. Sydney will offer the first Superfine sale of the season.

With the Italian buyers more active than we have seen for around 18 months, I would expect good support on the lots that meet their physical and technical specifications. Expectations for remaining Merino Fleece will be downward price pressure, based on the price offers being received by exporters at the time of writing.

__– Marty Moses __

Stay Connected

Subscribe

Get in Contact

Hilltops News to your inbox

Sign up now for the latest news from the Hilltops Area direct to your inbox.